A Real Conversation About Sacrifice, Options, and Hope

Let’s be honest, living on one income in today’s world feels almost impossible for most families.

Groceries are high. Housing is high. Childcare is high.

And no matter how much you cut back, it feels like the finish line keeps moving further away.

I know the frustration, because I’ve lived it.

Not decades ago in a different economy, but right here, right now, with today’s pressures, today’s prices, and today’s uncertainty.

So before anything else, hear this:

You’re not failing.

The system is hard.

And you’re doing your best.

In this guide, we’ll explore the proven options that helped my family thrive on one income, and how they might work for your family as well.

Sometimes the best thing you can do is pivot, adapt, and make choices other people won’t understand, because your family comes first.

My Wake-Up Call: Choosing a Different Path

I grew up knowing what struggle looked like.

I worked my first job at 14 because I wanted a different kind of life.

After high school, I graduated with honors, but college was financially out of reach.

No savings.

No scholarships that covered enough.

And I refused to take on student loans that would chain me for decades.

So I made a choice people questioned:

I joined the Air Force.

Not for glamour.

Not for adventure.

But because it was the only path that offered:

- A guaranteed paycheck

- Housing

- Education with no loans

- Medical coverage

- A real chance to break the cycle

I didn’t have a safety net.

I didn’t come from money.

But I had determination, and the military gave me the tools to build a future.

I served six years, earned three degrees, and walked away completely debt-free.

That decision changed the trajectory of my entire life.

The Conversation Nobody Wants to Have

Today, many people, especially younger generations, push back against the military.

Even my own sons feel strongly about it.

And I respect that.

Not everyone is built for that life.

Not everyone should join.

And yes, the military has its flaws.

But here’s a truth people don’t talk about:

Serving 3–4 years and transitioning to the Reserves for 20 can unlock benefits that transform a family’s life.

Benefits like:

- Free or nearly free college (for you and potentially your children)

- VA home loan eligibility, no money down

- In our case? No closing costs

- Medical benefits for life

- Travel through Space-A hops

- Housing and insurance discounts

- A steady retirement check after 20 years in the reserve component

These are benefits people don’t fully appreciate until they’re paying full price in civilian life.

Is it the right path for everyone? No.

Is it a path worth understanding? Yes.

For some families, it’s the only real ladder out of lifelong financial struggle.

Vocational Schools, Tech Programs & Skilled Trades Matter

Another truth people overlook:

Four-year degrees are not the only path to stability.

Many vocational and technical careers offer:

- Faster training

- Lower tuition

- High job demand

- Strong salaries

- Better work-life balance

- Less burnout

Electricians, HVAC techs, dental hygienists, ultrasound techs, welders, cybersecurity specialists — these careers often pay more than degree jobs without the crushing debt.

We need to bring back pride in skilled work.

Families can absolutely thrive on one income when that income comes from:

- A trade

- A certification program

- A tech bootcamp

- A short-term, high-value program

These routes build stability without decades of student loan payments.

College Is Still an Option, But You Must Be Strategic

I am not anti-college.

But I am against unnecessary debt.

If your goal includes college, there are smarter ways to do it:

- Start at community college

- Choose in-state universities

- Use employer tuition reimbursement

- Apply for FAFSA, grants, and local scholarships

- Take dual-enrollment credits in high school

- Consider accredited online programs

- Pair college with Reserves or National Guard benefits

Degrees matter… but the debt you avoid matters more.

So… Is One-Income Living Still Possible?

Yes.

But not by using strategies from 20 or 30 years ago.

It takes:

- Intentional choices

- Sacrifice

- Creativity

- Careers that match today’s economy

- Benefits and programs people rarely talk about

- A long-term plan

From what I’ve lived and witnessed, here are the four biggest factors that make one-income living realistic today:

1. Choose the right career or training upfront.

Stable industries + the right program = higher earning potential.

2. Leverage benefits (education, housing, medical).

Especially through military service, public service, and employer programs.

These benefits can save families hundreds of thousands over a lifetime.

3. Reduce lifestyle pressure.

Not deprivation, just alignment with what truly matters.

4. Have a long-term, not survival-mode, plan.

Intentional budgeting, reducing debt, and knowing your “why” are essential.

My Family’s Reality

We lived on one income for many years.

Not because it was easy, but because it was right for our family.

My husband’s military service, and mine before that, gave us a foundation:

- Housing stability

- Medical coverage

- Education

- Travel

- Predictable income

We still had tight seasons.

We still faced uncertainty.

But the earlier sacrifices helped create long-term stability.

I share this because too many families feel powerless, like every door is closed.

But there are doors.

Sometimes they’re just the doors people don’t talk about openly.

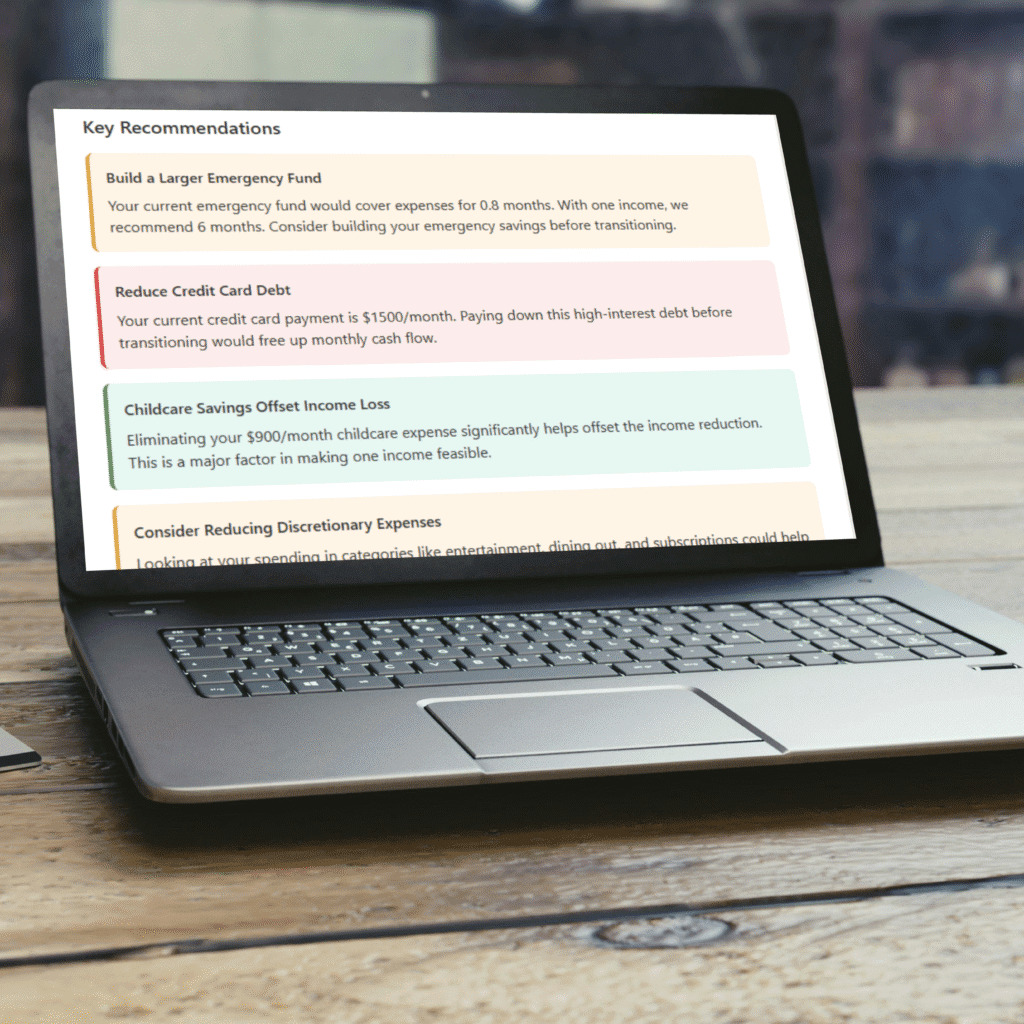

If you’re thinking about transitioning to one income, my free One-Income Calculator can help you see exactly what’s possible for your family. It breaks down your budget, estimates your real monthly needs, and even shows you what to adjust to make one-income living work. You can try it for free right here.

Final Thoughts: Hope, Not Pressure

If you’re struggling on one income, or trying to transition to one, you’re not alone.

Your struggle isn’t failure.

It’s a reflection of an economy that makes everything harder.

But I want you to know this:

There is more than one path forward.

You still have options.

And there are real ways to build a future that doesn’t bury you in debt.

Your path doesn’t have to look like mine.

But I share my story because sometimes real life is the best proof that hope is still possible.

You can build a stable, peaceful one-income life with the right decisions, the right tools, and the proper support behind you. Try the FREE One Income Calculator Here

And I’m here to help you explore those possibilities with clarity and confidence.

Frequently Asked Questions

Yes. Many couples thrive on one income through disciplined budgeting, an emergency fund, a debt strategy, and targeted income-replacement tactics (side hustles, contract work). Start with a clear plan and small, measurable steps.

Freeze discretionary spending, calculate your bare-minimum monthly essentials, and create a temporary budget. Simultaneously begin or boost an emergency fund. Use an income-gap calculator to see how much shortfall you must cover.

Aim for 6–12 months of essential living expenses. If the switch followed job loss or you expect more volatility, target 9–12+ months. Use an emergency fund calculator personalized to your household size and fixed costs.

Continue any employer 401(k) match if possible. If cash is extremely tight, pause only briefly and restart contributions as soon as the budget allows. Use a retirement-scenario tool to visualize the long-term cost of pauses and plan catch-up contributions.

Keep health insurance and disability insurance for the income earner. Consider term life insurance sized to cover mortgage and major obligations. Keep beneficiary and estate documents current and accessible.

Negotiate rent or refinance mortgage

Rent out a spare room or list unused space short-term

Reduce vehicle count, carpool, or schedule maintenance proactively to avoid big repairs

Refinance debts and consolidate where it lowers monthly payments

Check unemployment insurance, SNAP, WIC, childcare subsidies, energy assistance, and local nonprofit programs. A benefits-eligibility checklist saves time and may uncover short-term relief.

Prioritize high-interest debt first. Negotiate hardship plans or temporary lower rates with creditors if needed. Use a debt worksheet to compare avalanche (interest-first) vs. snowball (small-balance) strategies to see which best fits your psychology and cash flow.

Build a 3–6 month emergency buffer quickly

Cut discretionary spending immediately

Create short-term income plans (freelance, digital products, temporary work)

Apply for benefits (unemployment, assistance programs)

Keep resumes and networks active for re-employment

Create daily non-financial rituals (walks, low-cost date nights), celebrate small wins, and hold weekly money check-ins focused on solutions, not blame. Emotional resilience is as practical as cash reserves.